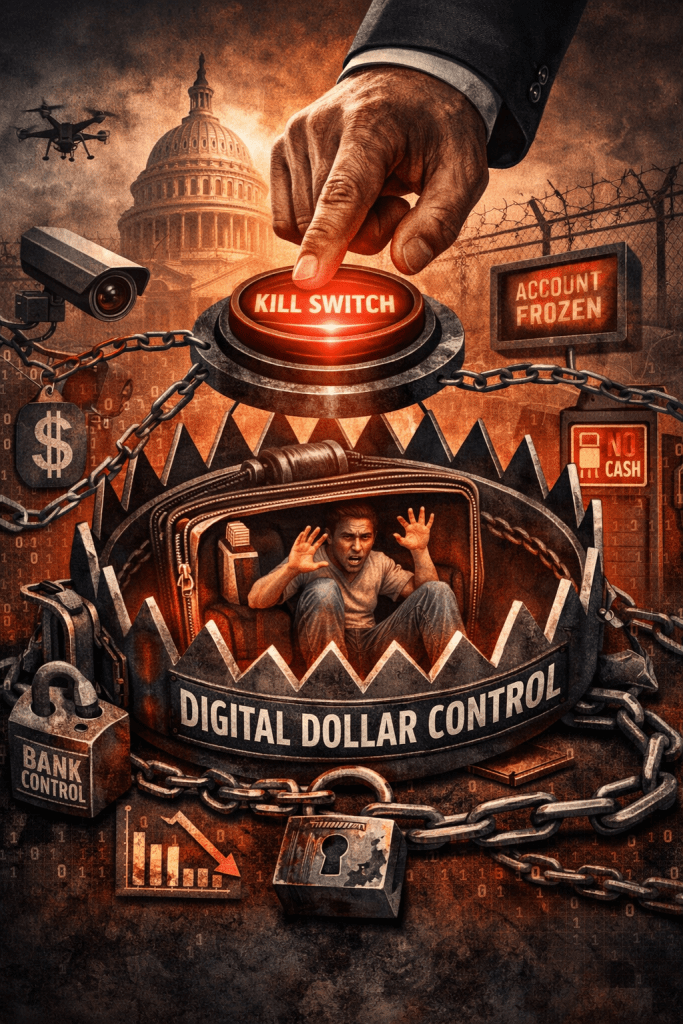

How You, Your Family, and Your Dollars Just Got Fitted with a “Kill Switch”

It’s 2026. A massive fire hits your county. The cell towers are down. Go out to buy gas to get your family out of town, but your ‘Digital Dollar’ wallet won’t open. No internet, no money. Or could be worse—the grid is up, but a bureaucrat in D.C. didn’t like your last social media post, and now your bread money is ‘frozen’ at the software level. This isn’t a conspiracy. It’s

The “GENIUS ACT.”

The “GENIUS Act” didn’t just digitize your wallet; it put a leash on your life. That isn’t progress—that’s increased social control, and a trap door to imprisonment. Whether it’s a politician’s grudge or a regional blackout, your ability to survive is now one software update away from extinction if all your digital dollars just disappear.

*

Meet Joe Sixpack. Joe is a simple guy. He works hard, pays his bills, and likes the fact that when he has a $20 bill in his pocket, it belongs to him. No one can remotely “turn off” that $20 bill. If Joe wants to buy a used lawnmower from his neighbor for cash, the government isn’t a silent third party at the kitchen table recording this transaction.

But as of 2026, Joe’s world is changing.

Under the deceptive banner of “innovation” and “consumer protection,” the federal government has rolled out the GENIUS Act (The Guiding and Establishing National Innovation for U.S. Stablecoins Act).

On the surface, it sounds like a win-win. It promises faster payments and stable digital dollars. Drug money laundering could be stopped. But if you look under the hood, the GENIUS Act isn’t just a financial upgrade; it’s the most sophisticated social control network ever built. It’s a weapon held by the government, and depending on who is in power, that knife can either carve a path for progress or cut Joe Six-Pack completely out of society.

The “Hidden Tax” and the End of Privacy

Full disclosure? The primary reason the government fast-tracked this law wasn’t to help Joe send money faster. It was to close the “Tax Gap,” to increase internal revenues, and expand irrational expenditures.

For decades, billions of dollars in “under-the-table” transactions have escaped the IRS. By funneling Joe’s daily life into GENIUS-compliant stablecoins, the government has achieved the ultimate dream of every tax collector in history:

The 100% Traceable Economy.

Every stablecoin transaction is now a data point on a ledger. There are no more anonymous handshakes. If Joe’s neighbor mows his lawn for $50 in digital dollars, the “Broker” (the app Joe uses) is legally required to report that transaction. The government doesn’t have to audit you anymore; the software does it in real-time. This isn’t just about catching tax cheats; it’s about the total visibility of every cent you earn, save, and spend.

The Social Control Feature: The “Kill Switch”

This is the part that should scare the beejebers out of you.

Under the GENIUS Act, every licensed stablecoin issuer (like Circle, PayPal, or your big bank) is required by law to have the technical capability to “freeze or burn” tokens. In plain English? The government has a remote “Kill Switch” for your money.

Imagine a future where a “Person of Interest”—let’s say a political critic or a protestor—is identified by facial recognition at an event the government doesn’t like. In the old world, that person could still go to a diner and buy a sandwich with cash. In the GENIUS world, the Treasury can issue a “Lawful Order” to freeze that person’s digital wallet instantly. Gone broke.

No trial. No jury. Just a line of code that turns your life savings into useless digital dust. Because these coins are “programmable,” the government can even restrict where you spend. Imagine money that works at the grocery store but is automatically rejected at a gun shop or a donation site for an “unapproved” cause. This isn’t science fiction; it is the literal requirement for any stablecoin to be legal in the U.S. today.

The “Lights Out” Scenario: The Ultimate Fragility

But there is an even darker side to this digital utopia. The GENIUS Act assumes the “lights” will always stay on. Imagine a “Lights Out” scenario: a massive regional fire, a cyberattack on the power grid, or an EMP (Electromagnetic Pulse). In this moment of total crisis, Joe Sixpack needs to grab his family and run. He needs gas, food, water, and a motel room.

In a digital-only economy, Joe is paralyzed. If the cell towers are down and the internet is fried, his “GENIUS” dollars are non-existent. You can’t “tap-to-pay” when the grid is dead. The government’s shiny new financial network has a single point of failure: Electricity.

In this scenario, the “barter system” returns with a vengeance. The only person who survives is the one who ignored the digital trend and kept a private store of physical cash or ‘dirty’ silver. Physical cash is a “bearer instrument”—it works because you hold it. It doesn’t need to check with a electronic server in D.C. to see if you’re a “good citizen” before it lets you buy a gallon of gas, or a sandwich.

By aggressively pushing us away from cash and into the GENIUS Act framework, the government is trading our resilience for their control. They are making the entire economy “EMP-vulnerable” just so they can track Joe’s $10 lunch.

The Choice for Joe

The GENIUS Act is being sold as the future of money. And for many, the convenience will be intoxicating. Instant paychecks, no bank fees, and “safe” digital dollars.

But Joe Sixpack needs to realize that every time he chooses the convenience of the digital dollar, he is handing over a piece of his personal freedom. He is moving into a world where his ability to feed his family is “permission” granted by a 27-year-old bureaucrat with a laptop.

The GENIUS Act has turned the U.S. Dollar into a tool of surveillance and a weapon of social compliance, similar to the Chinese system, designed to ensure that the government knows what you have, knows where you are, and has the power to stop you . . . anywhere, anytime.

So, keep your apps updated, Joe. But for the sake of your family and your freedom, keep your “hiding spot” cash even closer. Because when the lights go out—or when the “Kill Switch” gets flipped—that paper in your pocket might be the only thing that can still say you’re a free man.

The STATE Survival & Sovereignty Matrix: 2026

Some States have passed “Payment Choice” laws. These laws make it illegal for a store to refuse Joe’s cash. They see that dangerous “control network” and are trying to keep the “cash exit” open for people like Joe.

As of January 27, 2026, the states with statewide laws requiring (in general) that in-person retail businesses cannot refuse cash are:

Arizona, Colorado, Connecticut, Delaware, Idaho, Maryland, Massachusetts, Michigan, Mississippi, Montana, New Jersey, Oregon, Rhode Island, South Carolina, Tennessee, and West Virginia.

New York: a new statewide cash-acceptance law is enacted but not yet in effect; it’s expected to take effect March 20, 2026.

Several California cities do require cash acceptance, which effectively limits payment choice for merchants:

- San Francisco

- Los Angeles

- Oakland

In those jurisdictions, cashless-only businesses are illegal, regardless of state-level neutrality.

New Hampshire Granite Staters, mark your calendars for January 29, 2026. That is the day HB 1284 hits the floor. If you want to keep the ‘Digital Death-Trap’ at bay and ensure your right to buy bread when the power is out, this is the bill that keeps your money yours.

Without it, New Hampshire’s ‘Live Free or Die‘ will just be a slogan on a dead iPhone screen.”

If you’d like more insights, visit RMDellOrfanoAuthor.com under the blog category … Wealth, where conscience, culture, and spirit intersect.

If you like what you read, please refer this site to others.

Leave a comment