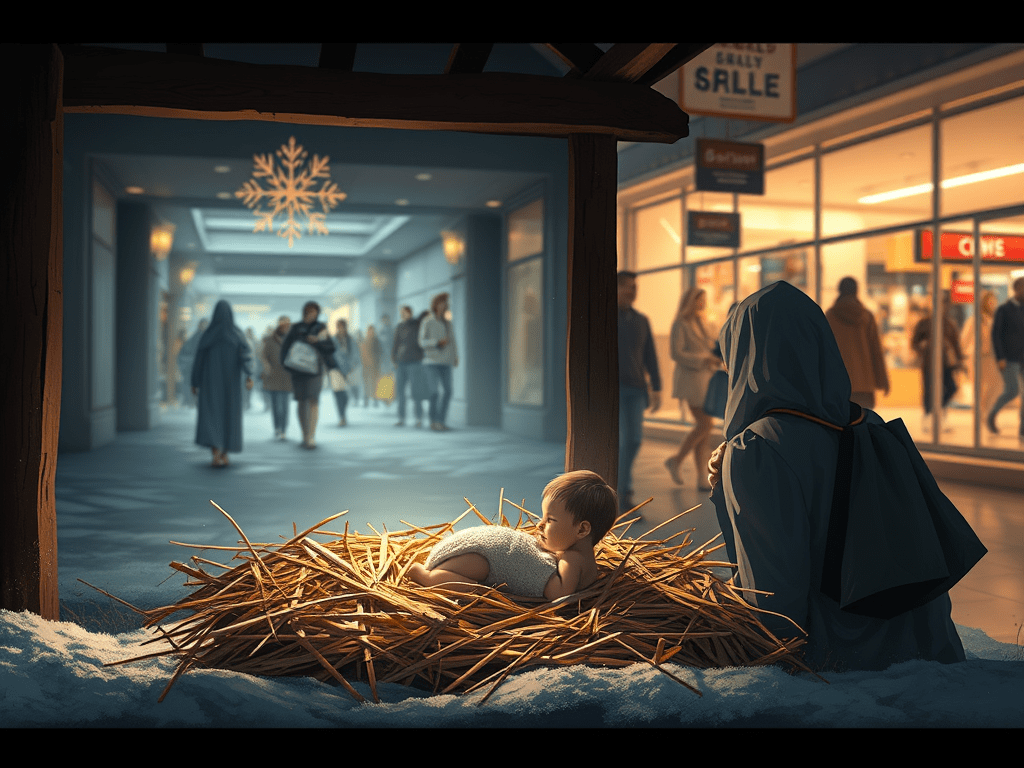

From the manger to the mall: economic forces hollowing out family life

Christmas did not begin in comfort.

It began in exposure—stone and straw underfoot, cold air biting the skin, the smell of animals heavy in the dark. There was no running water to wash blood or hands, no furnace against the winter night, no sweetness in the air—only dung, hay, breath, and necessity. A child was laid where animals fed, not because it was fitting, but because there was no room elsewhere. That poverty was not decorative. It was the condition into which God chose to enter the world.

Christmas is wrapped in comfort and excess, and the humility of the manger has been forgotten.

We venerate a birth marked by poverty and cold while insisting on lives shielded from deprivation. We display Nativity scenes and celebrate elaborate liturgies to remind us of what we have already forgotten. We speak of family while we shop till we drop—pricing it out of existence.

That contradiction is not merely cultural. It is economic.

I have often wondered why I never married. I would often dwell on the emotional questions; those are plain enough. What I failed to consider until much later were the economic conditions that once made marriage and genuine family life possible—and that now quietly undermine them.

In the 1950s, one income sustained a household.

When I was a teenager, my father wore one hat five days a week. My mother wore many, seven days a week—housewife, chauffeur, nurse, babysitter, laundress, cook, seamstress, counselor, cleaning lady, snow shoveler, bird and wild-cat feeder, bookkeeper, shopper. There was never a discussion about splitting costs. One income was enough.

Those days are gone.

Today, two incomes are not a choice—they are a requirement.

Not because human needs have changed, but because money has been steadily devalued. Decades of Federal Reserve money creation—used to fund expanding social programs and perpetual wars—have hollowed out the purchasing power of wages.

A few plain numbers tell the story.

A three-cent postage stamp now costs seventy-eight cents—a 2,500% increase. A modest house that sold for under $20,000 in 1955 now averages about $450,000—again, roughly 2,500%.

Education exposes the imbalance even more starkly.

In 1959, a four-year college education cost about $8,000.

Today, that same education often approaches $320,000—a 4,000% increase.Back then, a newly graduated engineer could pay off his entire education with one year’s salary. Education was a ladder—steep, but solid.

Today, that same degree can consume four full years of earnings.

Before taxes. Before housing. Before food. Before family.

Cost Per Child (Christmas Gifts Only)

1955: While specific per-child gift data for 1955 is sparse, popular toys like a Slinky ($1.00) or a Barbie doll (introduced in 1959 for $3.00) cost a fraction of today’s tech-heavy gifts.

2025: Parents expect to spend an average of $521 per child on gifts alone this year

Household income tells a different story.

The average household income rose only about 1,700%.

That missing 800% is not progress. It is a silent tax.

Families cannot absorb that cost. So they borrow. Children begin adult life already in heavy debt. Marriage is long delayed. Children are postponed—or never arrive. Financial stability becomes a luxury.

This strain does not stay on balance sheets. It seeps into marriages.

Financial pressure corrodes patience, breeds resentment, and fractures trust. The moral and relational decay described in stories like the one linked below is not mysterious. It is the predictable result of economic pressure applied relentlessly over generations.

https://www.yahoo.com/lifestyle/articles/husband-43-says-wife-doesnt-203035804.html

The solution is not to abolish the Federal Reserve.

That is a distraction. The deeper problem is us.

We-the-People have demanded endless comfort, safety, convenience, and intervention—without restraint or cost. Congress delivers what is loudly and relentlessly requested. Inflation is not imposed by tyrants alone; it is voted in, applauded, and financed by debt we prefer not to see.

Unless there is a genuine reckoning—a contraction, a depression, a forced reset—nothing fundamental will change.

Only when excess is stripped away does humility return.

Only when abundance fails do illusions dissolve.

As God was born in poverty, godliness rekindles only through humility.

Christmas was never about abundance.

It was about humility.

The manger was not an accident.

It was the lesson.

If you’d like more insights, visit RMDellOrfanoAuthor.com under the blog category … Religion or Politics, where conscience, culture, and spirit intersect.

Leave a comment